- +234 70 4149 7660

- info@ekundayoeduconsult.com.ng

- Lagos Nigeria

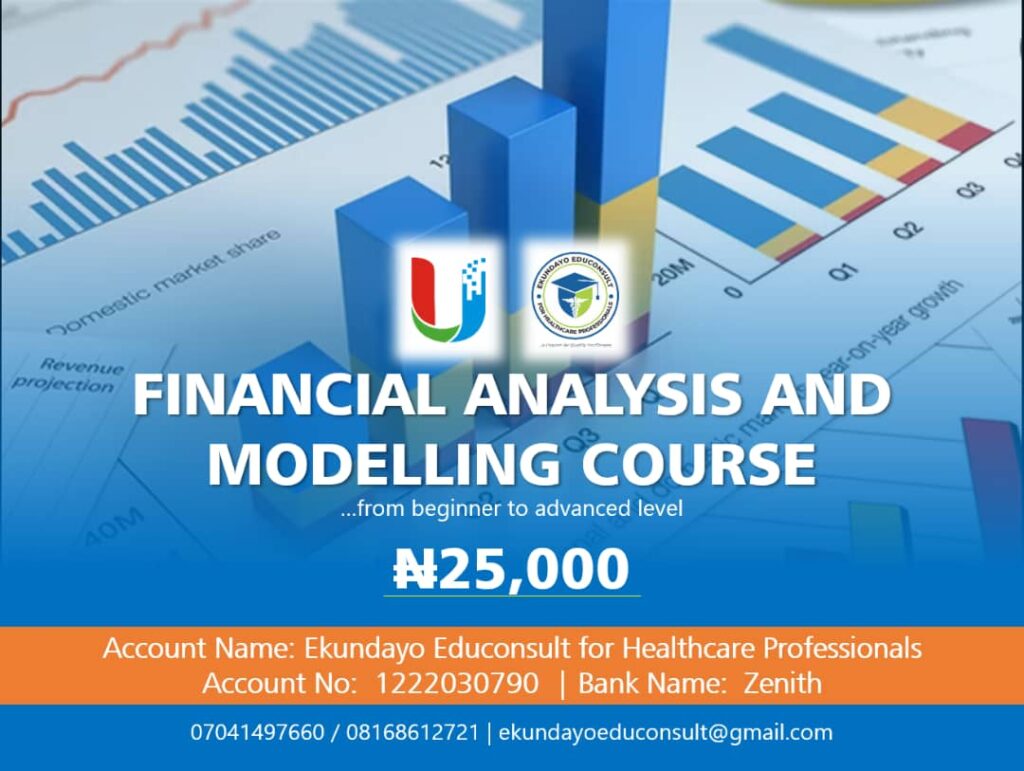

Financial Analysis and Modeling

Financial Analysis and Modeling.

Overview on the importance of the Financial Analysis certification course:

You do not need an MBA to know how to analyze financial data. You do not even need a background in accounting or finance. With the nature of work nowadays and demands at workplaces, you need more than your core skills to stay productive and flexible. This course will teach you financial analysis and modeling from the very beginning to advanced level. This is one course you should go for. Financial Analysis is a skill on high demands now.

Enroll now!!!

- Professional Ethics

- Excel Accounting Fundamentals

- Formulas & Functions for Finance

- Debits and Credits

- Journal Entries

- Trial Balance

- T-Accounts

- Reading Financial Statements

- Types of Financial Statements

- Cash VS Accrual Accounting

- Depreciation

- Inventory and COGS

- Advanced Excel Formulas & Functions

- Income Statement

- Constructing an Income Statement

- Balance Sheet

- Constructing a Cash Flow Statement

- Financial Statement Analysis

- Compound Annual Growth

- Building a 3 Statement Financial Model

- Conditional Formatting: Top/Bottom Analysis

- Pivot Tables for Financial Analysis

- Financial Leverage: Calculating Loans

- Budgeting and Forecasting

- Scenario & Sensitivity Analysis in Excel

- Building Financial Dashboards & Data Visualization

- Projects and Case Studies

PAYMENT AND REGISTRATION DETAILS

Company’s Account

1222030790

Zenith Bank

Ekundayo Educonsult for Healthcare Professionals.

Domiciliary Account

3184967233

First Bank of Nigeria

Mustapha Yusuf Ekundayo

For International Students

Any of the options below can also be used

– Western Union

– Money gram

– World Remit

– Mukuru, etc

Send proof of payment through our WhatsApp Chat Icon visible on every page

Financial Analysis and Modelling

Introduction to Financial Analysis and Modeling

Financial analysis and modeling are critical skills for anyone involved in corporate finance, investment, or strategic decision-making. By analyzing financial data and building predictive models, professionals can make informed decisions that drive business success.

This comprehensive guide will explore the essentials of financial analysis and modeling, including tools, techniques, and real-world applications to help you master these invaluable skills.

1. What is Financial Analysis?

Financial analysis involves evaluating a company’s financial data to understand its performance and forecast future trends. Key activities include:

- Ratio Analysis: Assessing liquidity, profitability, and efficiency.

- Trend Analysis: Identifying patterns in financial data over time.

- Forecasting: Estimating future financial outcomes based on historical data.

2. What is Financial Modeling?

Financial modeling is the process of creating a structured representation of a company’s financial performance using spreadsheets or specialized software. These models help simulate different scenarios to guide investment and operational decisions.

Types of Financial Models:

- Three-Statement Model: Integrates income statement, balance sheet, and cash flow statement.

- Discounted Cash Flow (DCF) Model: Calculates the present value of future cash flows.

- Budget Model: Helps plan and manage expenses.

- Mergers and Acquisitions (M&A) Model: Analyzes potential synergies and impacts of business mergers.

3. Importance of Financial Analysis and Modeling

3.1 Decision-Making Tool

Financial analysis and modeling provide insights that are crucial for:

- Investment decisions

- Risk management

- Strategic planning

3.2 Business Valuation

Understanding a company’s value is essential for acquisitions, mergers, or raising capital.

3.3 Performance Monitoring

Regular analysis helps track whether a business is meeting its financial goals.

4. Key Skills for Financial Analysis and Modeling

4.1 Technical Skills:

- Proficiency in Excel for calculations and building models.

- Knowledge of financial software like Tableau, Power BI, or QuickBooks.

4.2 Analytical Thinking:

Ability to interpret complex data and derive actionable insights.

4.3 Understanding of Financial Statements:

In-depth knowledge of income statements, balance sheets, and cash flow statements.

4.4 Attention to Detail:

Ensuring data accuracy and integrity within models.

5. Tools for Financial Analysis and Modeling

5.1 Microsoft Excel:

A versatile tool for creating models, performing calculations, and visualizing data.

5.2 Financial Modeling Software:

- Quantrix Modeler for scenario analysis.

- Crystal Ball for risk assessment.

5.3 Data Visualization Tools:

- Power BI

- Tableau

6. Steps to Build a Financial Model

6.1 Gather Data:

Collect relevant financial information, including historical data, market trends, and assumptions.

6.2 Create Assumptions:

Base your model on realistic assumptions about growth rates, interest rates, and market conditions.

6.3 Structure the Model:

- Build the income statement, balance sheet, and cash flow statement.

- Link these sheets to ensure consistency.

6.4 Validate the Model:

Check for errors, test different scenarios, and ensure accuracy.

6.5 Analyze Outputs:

Interpret results to guide business decisions.

7. Applications of Financial Analysis and Modeling

7.1 Investment Analysis

Helps evaluate potential investments by forecasting returns and assessing risks.

7.2 Budgeting and Forecasting

Supports planning and allocation of resources within a company.

7.3 Business Expansion

Analyzes the financial feasibility of entering new markets or launching new products.

7.4 Risk Management

Identifies and mitigates potential financial risks.

8. Benefits of Financial Analysis and Modeling

8.1 Improved Decision-Making

Provides data-driven insights to support strategic choices.

8.2 Competitive Edge

Businesses with robust financial models can adapt quickly to market changes.

8.3 Enhanced Communication

Clear models and analysis improve stakeholder understanding.

8.4 Career Advancement

Professionals skilled in financial modeling are in high demand across industries.

9. Challenges in Financial Analysis and Modeling

9.1 Data Quality

Accurate modeling relies on reliable data sources.

9.2 Complexity

Building complex models requires advanced skills and time investment.

9.3 Bias in Assumptions

Over-optimistic assumptions can lead to unrealistic projections.

9.4 Continuous Updates

Models must be updated regularly to reflect changes in the market or business.

10. How to Learn Financial Analysis and Modeling

10.1 Enroll in Professional Courses

Many institutions offer specialized training in financial analysis and modeling, including certifications.

10.2 Practice on Real Data

Gain hands-on experience by analyzing financial reports of companies.

10.3 Use Online Resources

Explore tutorials, webinars, and case studies to enhance your skills.

10.4 Join a Community

Participate in forums and groups for financial professionals to share insights and experiences.

11. Why Choose Ekundayo Educonsult for Financial Analysis Training?

- Expert Instructors: Learn from seasoned financial analysts.

- Comprehensive Curriculum: Covering basic to advanced techniques.

- Flexible Learning Options: Online and in-person courses available.

- Industry-Relevant Tools: Hands-on experience with modern financial tools.

12. Start Your Financial Analysis and Modeling Journey

Financial analysis and modeling are indispensable for professionals in today’s business world. Mastering these skills can help you make data-driven decisions, forecast future performance, and add significant value to any organization.

At Ekundayo Educonsult, we offer top-notch training programs designed to equip you with the knowledge and tools you need. Whether you’re a beginner or looking to refine your skills, we have a course for you.

Take the first step today by enrolling in our Financial Analysis and Modeling course!